Strengthening compliance and risk management with Elastic Observability: A case for India's banking sector

In navigating the complex landscape of regulatory compliance and risk management, India's banking sector faces unique challenges, particularly in meeting directives outlined by the Reserve Bank of India (RBI) and the Indian Computer Emergency Response Team (CERT-In). As organizations strive to adhere to these stringent requirements, Elastic Observability emerges as a powerful ally, offering advanced log analytics capabilities tailored to address regulatory mandates and mitigate operational risks.

RBI directives

RBI’s directives underscore the importance of meticulous audit and logging practices to protect critical and sensitive information. Key aspects include:

Information Technology Governance, Risk, Controls, and Assurance Practices (November 7, 2023): RBI requires IT applications that access critical information to have comprehensive audit and system logging capabilities. These logs must be detailed enough to facilitate audits, serve as forensic evidence, and assist in dispute resolution. Regular monitoring of these logs is essential to detect unauthorized activities and ensure compliance. (RBI Notification)

Digital Payment Security Controls (February 18, 2021): The directive mandates that mobile and internet banking applications have effective logging and monitoring capabilities. This includes tracking user activities and security changes and identifying anomalous behavior to prevent fraud and enhance security. (Digital Payment Security Controls)

CERT-In directives

CERT-In's directives focus on the secure maintenance and availability of logs for ICT systems, emphasizing:

- Directions under Section 70B, Information Technology Act, 2000 (April 28, 2022): CERT-In mandates that all service providers, intermediaries, data centers, body corporates, and government organizations enable logging for all ICT systems and maintain these logs securely for a rolling period of 180 days within Indian jurisdiction. These logs must be available for submission to CERT-In upon request or during incident investigations, ensuring transparency and compliance with national cybersecurity standards. (CERT-In Directions)

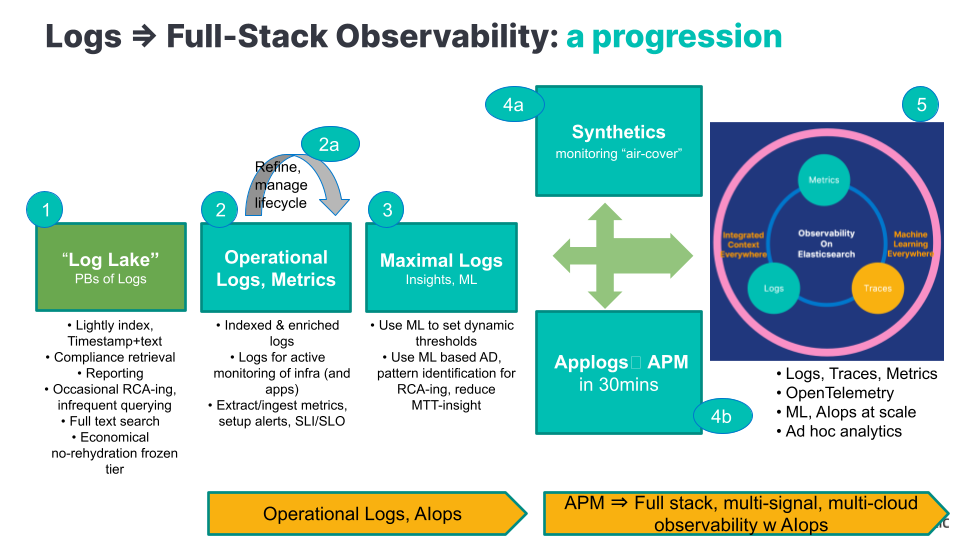

Elastic Observability: An ally for compliant log analytics

Elastic Observability's log analytics capabilities have been instrumental in helping some of India's largest banks not only achieve compliance requirements but also tackle advanced monitoring and risk management use cases.

Elastic's log analytics solution, part of Elastic Observability, allows you to ingest once and leverage the data everywhere. It provides a comprehensive toolkit for log analytics, including:

Elasticsearch for storing, searching, and analyzing large volumes of log data

Various integrations like Elastic Agent, Logstash, and Beats for ingesting, processing, and transforming log data from multiple sources

Kibana for creating interactive dashboards, charts, and visualizations to explore and understand the log data

By leveraging the Elastic Stack, organizations can gain valuable insights from their log data, quickly resolve application and system issues, and proactively plan for future challenges. Elastic's log analytics solution is designed to scale, integrate, and provide cost-effective log management for enterprises of all sizes.

With Elastic, organizations can benefit from the following capabilities:

Scale with confidence: Deploy and manage logs at any scale, ensuring readiness to handle large volumes of data efficiently.

Real-time insights: Gain actionable insights from logs within minutes, enabling swift decision-making and issue resolution.

Comprehensive search: Utilize powerful search functionalities to explore data across diverse sources, enhancing visibility and control.

Live troubleshooting: Respond to system issues and anomalies in real time with live troubleshooting capabilities.

Anomaly detection: Identify patterns and outliers through log categorization and anomaly detection, enhancing proactive threat mitigation.

Compliance reporting: Generate reports from logs to facilitate compliance audits, ensuring adherence to regulatory requirements.

- Comprehensive monitoring: Monitor applications, infrastructure, and user activities within a single solution, fostering operational excellence and risk management.

Proven success in India's banking sector

Elastic has a demonstrated track record of assisting some of the largest banks in India not only in meeting compliance requirements but also in solving advanced monitoring and risk management use cases. By leveraging Elastic Observability, these organizations have strengthened their security posture, achieved operational excellence, and mitigated regulatory risks effectively.

Elastic Observability emerges as a cornerstone solution for India's banking sector in navigating regulatory compliance and mitigating operational risks. With its robust log analytics capabilities and proven success in addressing the diverse needs of the banking industry, Elastic stands ready to empower organizations in their journey toward compliance and risk management excellence.

Learn more about Elastic Observability’s log monitoring and analytics capabilities.

The release and timing of any features or functionality described in this post remain at Elastic's sole discretion. Any features or functionality not currently available may not be delivered on time or at all.